Flood Insurance

Other than fire, there is nothing more destructive to your home than water damage. Yet too many homeowners make the mistake of assuming that their homeowner's insurance covers flood damage. Spring thaw and other types of extreme weather can cause major flooding. Is your home protected?

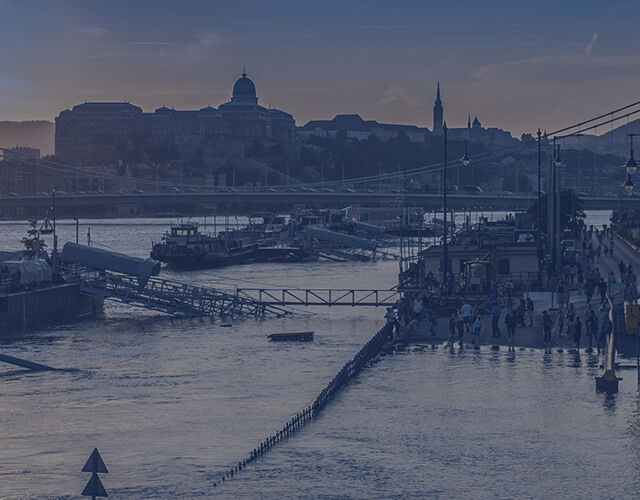

Large amounts of moving water can occur any time there are extreme weather conditions.

Sometimes floods develop slowly and allow homeowners time to react. Overland flooding is the most common type of flood, and it occurs when rivers or streams overflow their banks. Another type of flood is caused after a heavy rain or sudden snowmelt, and the amount of water exceeds the size of underground drainage, sewer pipes, and street drains that are designed to carry water away from communities.

If you live along coastal New England, you are very familiar with tropical storms, which are common along the Atlantic seaboard. In addition to heavy rainfall, hurricanes can be accompanied by high winds that sometimes exceed 155 miles per hour. A hurricane creates storm surges along coastal areas and can cause flooding several hundred miles inland. Excessive rain caused by these storms can also trigger mud and landslides.

Named appropriately, flash floods can happen in minutes after a heavy rainfall, or a dam or levee break. This type of flood is especially dangerous not only because of the water speed and volume, but also because the water is filled with rocks and other debris.

Most standard homeowner's insurance policies do not cover flooding caused by extreme weather conditions such as spring thaws or generalized flooding that originates from outside your home. Even backed-up sewers aren't covered on most policies unless you pay extra for this coverage.

Between 2007 and 2011, the average residential flood claim was almost $30,000. A few inches of water damage inside your home can add up quickly. Buying flood coverage could protect your family from severe financial loss.

The cost for homeowner's insurance, water damage repair and content replacement depends on how much insurance you purchase and what it covers. A homeowner's policy with flood insurance usually covers all buildings and contents. However,

content insurance is optional, and the amount you need should be discussed with your agent.

Coverage limits through the NFIP are capped at $250,000 for your home and $100,000 for belongings. Although compatible with NFIP plans, excess flood insurance must be purchased on the private market. Your insurance agent can help you find

sellers in your area.

Flood insurance includes deductibles for both dwelling and personal property

coverage. This is the amount your insurer will subtract from a claim payment. Selecting higher deductibles will lower your rates, but you’ll owe more if you file a claim. With lower deductibles, your rates will increase but your policy will stretch further.

If you need to go beyond these limits, consider buying excess flood insurance. Excess flood insurance allows you to increase your coverage to fully insure your home and belongings when a federal policy isn’t enough. If your home is located in a

moderate-to-low-risk area, you might be eligible for preferred flood insurance rates if you include this product in your insurance portfolio along with other coverage such as auto insurance.

Homes located in flood zones are considered high-risk but are still eligible for standard-rate flood insurance policies. All homes located in high-risk flood areas that have a mortgage through a federally regulated or insured lender must purchase a flood insurance policy. Flood insurance premiums are based on certain factors including: